Rents and Values - are we at bottom

Market Update

Rents and Values - are we at bottom

Market Update - May 2023

May 2023

Despite being in May, the demand for rentals continues to be high which can be an indicator for future value growth.

The peak rental season for apartments typically spans from mid-January to mid-April. This period sees the highest demand for rentals due to job changes, people moving to different cities, and students starting new academic terms. So, we are in May right now and the demand for rentals is still going strong like it's February!

This is not good for renters and while one must feel for them, this is a great indicator for future value growth as most apartments correlate with the income they provide.

How do I keep track of this pressure?

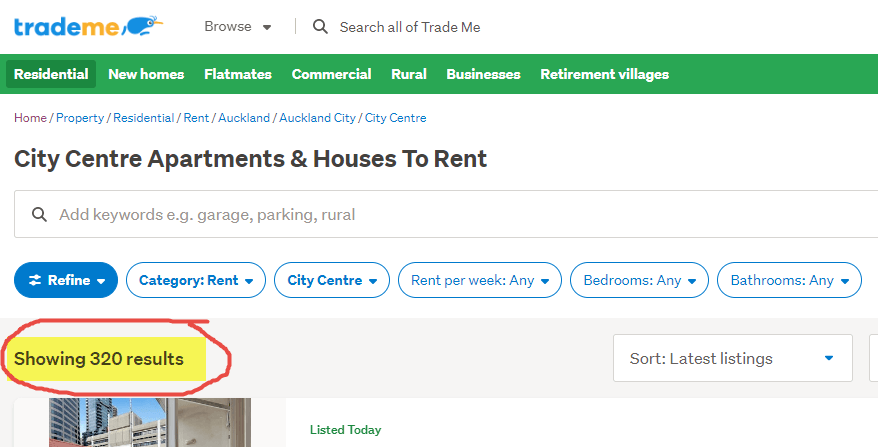

Other than checking in with numerous rental agents I look at the number of apartments listed for rent on TradeMe, New Zealand's most popular rental site. The lower the number... bigger the pressure.

Currently, the number of listings is at an all-time low of just 320 and it's May!

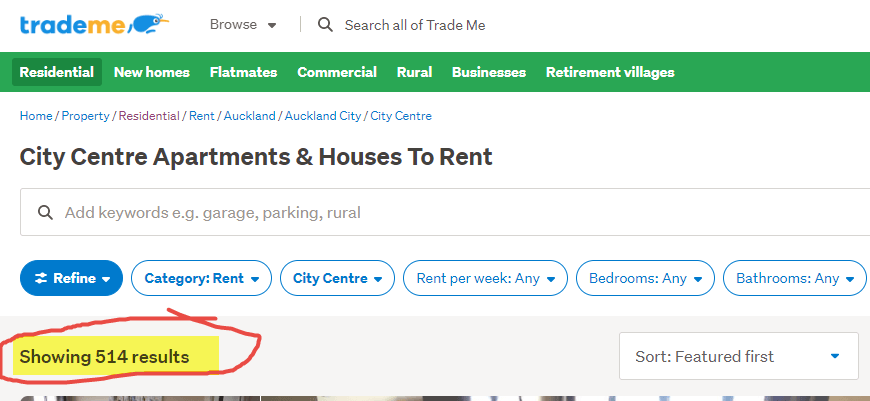

For this time of the year, it should be moving toward 500 like below which I took on the 12th of January just as peak season was kicking off.

So why is the rental market so strong?

It's not returning students, office workers, or completed infrastructure projects. In my opinion, this surge is primarily due to changes in immigration policy and a backlog of immigration demand due to COVID.

The influx of people coming into New Zealand right now is unprecedented – if we consider the 10,700 gain of migrants in February and extrapolate it over a year, we'd see annual figures nearly double the previous records. This is massive!

And the best thing is, it is putting more and more pressure on the fundamentals that drive values upwards. We are a recoiling spring right now!!

So again...I know what you are thinking. What about values then?

I won't sugar-coat it. We are not seeing values increasing. I wish we were but until we have interest rates play ball and some positivity in the property market, I can't see it.

Last Month I said we are at the bottom, but was I correct?

Identifying the bottom is tricky, but apartments offer some advantages. Large complexes often have numerous identical units, providing transparency in value.

Now we don't have enough large complexes or sales to determine every apartment category unfortunately, but I was able to cover the three main levels.

1. Investor apartments: smaller rentals below 50m2

2. Middle market owner-occupier or investor apartments: 45m2+ one-bed or 55m2+ two-bed units and larger in the CBD and suburbs

3. High-end apartments: All unit types in high-end complexes in CBD and suburbs

Investor apartments - smaller apartments (under 50m2), mostly rented.

4 of Auckland's largest investor complexes were fit out by the same architect and developer resulting in over 1000 apartments with almost identical floor plates. This provides us with a very accurate picture of where values are at.

The result from last 30 days: 8 sales and when compared to prior levels 1 result was lower than previous and 7 at or just above.

So, while not 100% conclusive, it is strong indicator of sideways movement and that the floor has been found in the smaller investor apartment space. Great news.

Middle-range owner occupier or rental apartments - 45m2 and larger one bedroom / 2 bedroom 50m2 or larger.

No 2- or 3-bedroom sales above 55m2 were lower than previous lows. The bottom looking like it has been found so far…but not one bedrooms.

50% of sales were at or slightly below previous lows for one bedrooms in the Suburbs and CBD with another 2 sales quite a lot below. This is indicating the bottom may still be some way away.

But it’s not all bad news…. I have my doubts. They were both purchased by traders who put them straight back on the market with NO improvements done at all. So my doubts – was it the market or was the sales methods or strategy chosen by the agent not in line with the property? They are both listed with a price so I will keep you posted.

High-end complexes

High-end units under 100m2 are not going down and are at the bottom or have moved above it from what I can see.

Units larger than this....it simply isn't possible to tell. High-end units above this size are not as repeatable and more often have been personalised to such a degree that accurate comparisons are hard to make with such low volume.... high-end sales make up the smallest proportion of all apartment sales.

My guess. We are at bottom and not going lower except for time-sensitive sales due to the extra time it takes to find the right buyer for high-end stock. (Twice as long on average)

Conclusion

While not definitive the last 30 days' activity is showing we are at the bottom or a smidgin above it for most of the apartment market except for the one-bedroom category I hope to bring you better news in the coming weeks.

Next month... I will be looking to solidify the above as well as wells as look to where the new rental levels are settling. I.e. If this rental demand continues it could settle 10% above pre-COVID highs!

And as always...