A perfect storm is brewing

Market Update

A perfect storm is brewing

Market Update - July 2023

July 2023

Auckland's apartment market is on the edge of a storm, with soaring prices, a record-breaking influx of immigrants, and a five-year window of no new supply looming ahead.

Last week I was looking at the future runway of apartments, normally a bit cumbersome, but not this time. This time it put me on the edge of my seat. Why?

There were no new apartment complexes of any size coming. I knew development costs had escalated and money much more expensive but seeing no complexes of any size lying ahead got me very excited and a weird feeling of déjà vu.

Why the excitement?

No new apartments coming to the Auckland Central area and surrounding suburbs for quite some time means no more supply, yet at the moment demand is increasing on a daily basis due to record immigration numbers - in the world of economics, this is a recipe for soaring prices.

So why Déjà vu?

Back in 2010/11, it was a quiet period for the apartment market, but like now, not a quiet time for its economic levers. Immigration started to turn from a meagre 3400 per year to 64,600 and rents were starting to rocket upwards and all happening in a 5-year window of no new apartments/supply.

2010/11 was the calm before the storm as from 2012 to mid-2016 apartments skyrocketed an alarming 100%. Fast forward to today and things are starting to feel very similar. Apartments aren't the flavour of the month, Immigration has turned from nothing to record numbers, rents have rocketed upwards and we are now in a window of no new apartments.

So why are no more apartments coming to Auckland Central and the fringe suburbs?

The high cost of land, materials, labour, and money for all development has doubled in the last 3 years, slowing all development. Yet it is exponentially worse for Central Auckland due to projects needing to be over 8 floors to be financially viable. And here lies the issue. When you go higher than 8 floors the construction expertise required, type and quantity of materials all drastically increase and in today's climate this results in a much more expensive and risker development.

So basically, the type of apartment construction which affects central apartment supply can't currently happen due to it not making financial sense.

So, for how long?

I can't see this situation changing too much in the next 12 months and with a project from conception to completion taking about 4 years we are looking at a whopping 5-year no-supply window if not more. Perfect.

Huh? There are new apartments still being marketed.

Look closer, they kicked off years ago but more importantly due to the new Unitary plan they are in the outer suburbs, under 8 floors and this is part of the problem. The new Unitary plan has created more profitable opportunities in suburbs further out where land is cheaper and construction much more economical. (Lower cost of land and more economical construction solutions)

But there are some new apartments on the fringe and in our CBD still selling.

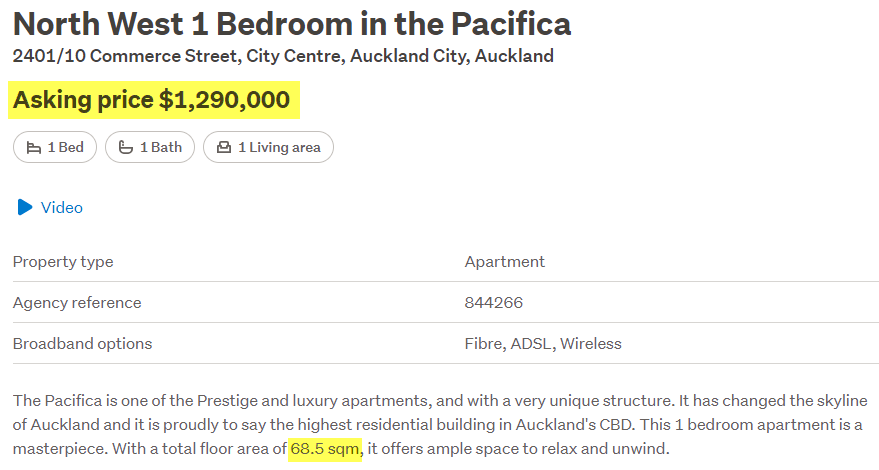

Yes, you are correct, they were kicked off years ago but also look at the price tag. Small boutique luxury complexes like One St Stephens and towers like Pacifica and Seascape are priced at double or even triple the normal market so we are talking about supply that won't influence the general market. In fact in regard to affecting the general apartment market they might as well not exist. For example, a 50m2 one-bedroom in the general market tops out at about $600,000 whereas super high-end will be closer to 70m2 but sell for closer to 1.3 million.

In fact, one of the Penthouses in Seascape just sold for $50,000 per m2. https://www.seascapeauckland.co.nz/penthouses

That's $2,500,000 equivalent for a small 50m2 one-bedroom Apartment by the per meter cost.

So, when is this going to happen?

Immigration is in full flight; rents have increased dramatically and with no new supply coming it is inevitable. So when and why not now? Two reasons.

1) Very high bank test rates of 9.5% and interest rates of 7% and

2) Loan to value Ratios of 35% for investors.

It is these two hurdles that need to be reduced before the apartment market can really take off. The good news is they are only at these levels to keep inflation in check and although it’s early days it looks to be working so they will ease in the coming years and when they do…boom time.

The financial markets expect this to be from mid-2024 with the only twist being all these new tools the Reserve Bank has come up with. Hence, I see it starting around this time with the large movement needing some momentum so 2025/26.

So, make sure you are well placed to benefit as we have a storm brewing.

Next month I will be talking about growth I’m seeing in a few categories indicating some recovery of value could occur, but we will see. Fingers crossed.

And as always...