22 Library Lane, Albany

- This location has been autonomously mapped, it may not be exact.

22 Library Lane, Albany

By negotiation

Affordable First Home

Standing out from the rest, perched up on the 4th floor and importantly on the corner of the complex ensures more natural light and neighbors only on one side of your new home. A couple of the reasons that corner apartments are always the most sought after in any building!

Still feeling new, as only completed in 2018 you'll be getting the modern feel, without the massive price tags here.

With construction costs having increased by 45% since pre covid days, we know that a property of this standard simply can't be built for the same price again. Those in the know understand how this also protects your investment here.

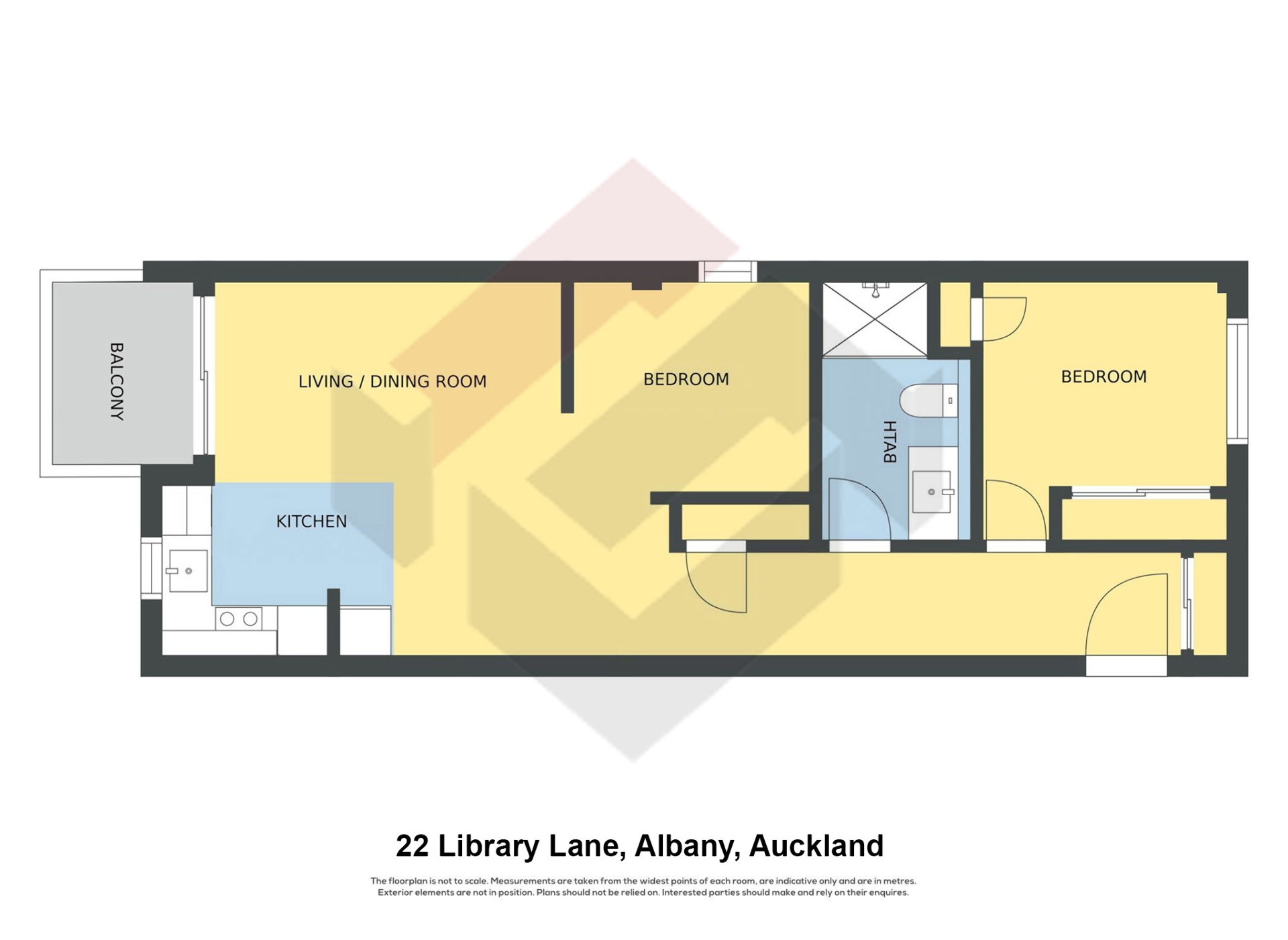

An intelligent layout ensures privacy if you're using the second bedroom as both bedrooms are kept apart from each other. With the master bedroom being at the back of the apartment, away from the open plan kitchen and living area.

And again...being on the corner of the complex ensures that both bedrooms have windows.

Get in touch for a private viewing.

Note: The chattels in the photos may vary from what is being sold, please check the chattels list if this is important to you.

Facts & Features

Title Type

Freehold

Rates

$2098.31

Rental Appraisal

$680-$730 /week

Estimated Net ROI

4.22%

Pets

Allowed with BC Consent

Henri Smith

Matt Kearns

Disclaimer: Apartment Specialist are often asked to give information as to the area or dimensions of properties, including rooms, decks and patios. Apartment Specialists sources such information from third party sources (for example Council records, building management records) and passes this on; unfortunately it is not uncommon for such information to be inaccurate. If exact and accurate sizes or dimensions is an important factor in your decision then you as Purchaser must make your own independent enquiry from your own chosen expert (for example a registered valuer).

Sneak Peek

Get a jump on the rest and get sent our latest listings before they go online.